Are Bitcoin ETFs changing the way the world’s leading cryptocurrency is owned?

The answer increasingly appears to be yes. As traditional finance embraces Bitcoin, ownership is shifting from everyday investors toward large institutions and regulated funds.

The Changing Face of Bitcoin Ownership

Since Bitcoin’s creation, self-custody has been a defining feature of the network — individuals held their own keys, free from intermediaries. But for the first time, that trend is starting to reverse.

According to Martin Hiesboeck, Head of Blockchain Research at Uphold, major Bitcoin holders are transferring billions in BTC into regulated spot Bitcoin ETFs. The reason? Institutional convenience, clearer tax structures, and the safety of regulated custodians.

From Retail to Institutions: 2020–2025 Data Breakdown

Using data from CryptoQuant and Dune Analytics, Bitcoin holders can be grouped into three segments:

- Retail investors: wallets holding under 10 BTC

- Whales: wallets with 10–1,000 BTC

- Entity-scale holders: entities controlling more than 1,000 BTC

2020 — The Early Era of Decentralized Ownership

In 2020, Bitcoin’s supply distribution looked far more balanced:

- Retail users held around 3.1 million BTC (≈17% of circulating supply)

- Whales controlled 9.7 million BTC

- Entity-scale wallets held 5.3 million BTC

Ownership remained heavily self-custodied, reflecting Bitcoin’s early ethos of financial independence.

2024 — The Spot Bitcoin ETF Turning Point

The approval of U.S. spot Bitcoin ETFs on January 10, 2024 marked a historic inflection point. For the first time, major financial institutions could gain direct exposure to Bitcoin under full regulatory oversight.

Leading up to this milestone, retail ownership rose 33.7% to roughly 4.1 million BTC, driven by optimism over ETF inflows. But after launch, the dynamic flipped — by 2025, retail holdings fell 20%, down to 3.4 million BTC, as many small investors took profits or shifted to ETF exposure.

Whales saw a modest uptick (to 9.9 million BTC) before declining 4.7% to 9.4 million BTC, hinting at redistribution toward OTC desks and ETF custodians.

Meanwhile, entity-scale holders — the largest players — expanded their share significantly. Their collective balance rose from 5.5 million BTC to 7.05 million BTC, a 21.7% surge within a year of ETF approval.

Institutional Adoption Accelerates

Since the ETF green light, more than 1.34 million BTC has been absorbed by U.S. spot Bitcoin ETFs, including BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund (FBTC).

This rapid inflow underscores Bitcoin’s institutional adoption. Funds, corporations, and retirement managers are no longer watching from the sidelines — they are actively adding BTC exposure to diversify portfolios and hedge against inflation.

Bitcoin’s Evolution: From Cypherpunk to Wall Street

This shift reflects a broader crypto market trend: the integration of decentralized assets into traditional finance.

For many, it’s a sign of Bitcoin’s maturity and global legitimacy. Regulated products make access easier, liquidity deeper, and volatility more manageable.

Yet critics argue that this growing institutional control erodes the original mission of Bitcoin — financial freedom and decentralization. The decline in self-custody suggests that the asset’s grassroots nature may be giving way to corporate ownership.

Conclusion

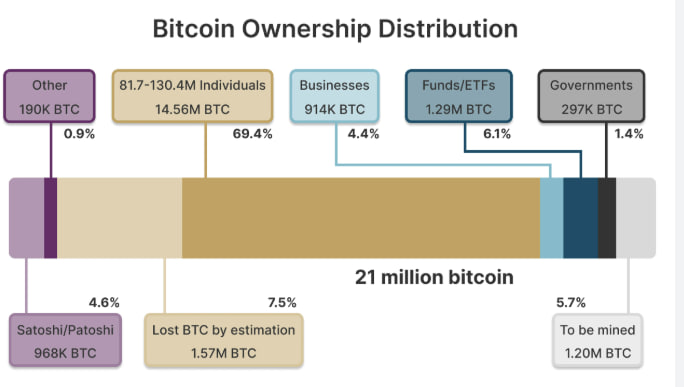

The Bitcoin ownership distribution of 2025 looks very different from that of 2020. Retail investors are holding less. Institutional funds and ETFs are holding more. And Bitcoin, once a symbol of personal financial sovereignty, is now becoming a mainstream institutional asset.

Whether that represents progress or compromise depends on perspective:

- To some, ETFs signal mass adoption and market maturity.

- To others, they represent the creeping centralization of an asset born to defy it.

Either way, the data is clear — ETFs are reshaping Bitcoin’s future, one custody transfer at a time.

Would you like me to add meta title and description tags (for SEO snippets on Google search results)?

I can also prepare a shorter version (≈150 words) for social previews or article introductions.

Source: https://cryptonews.com

Crypto Daddy

Crypto Daddy